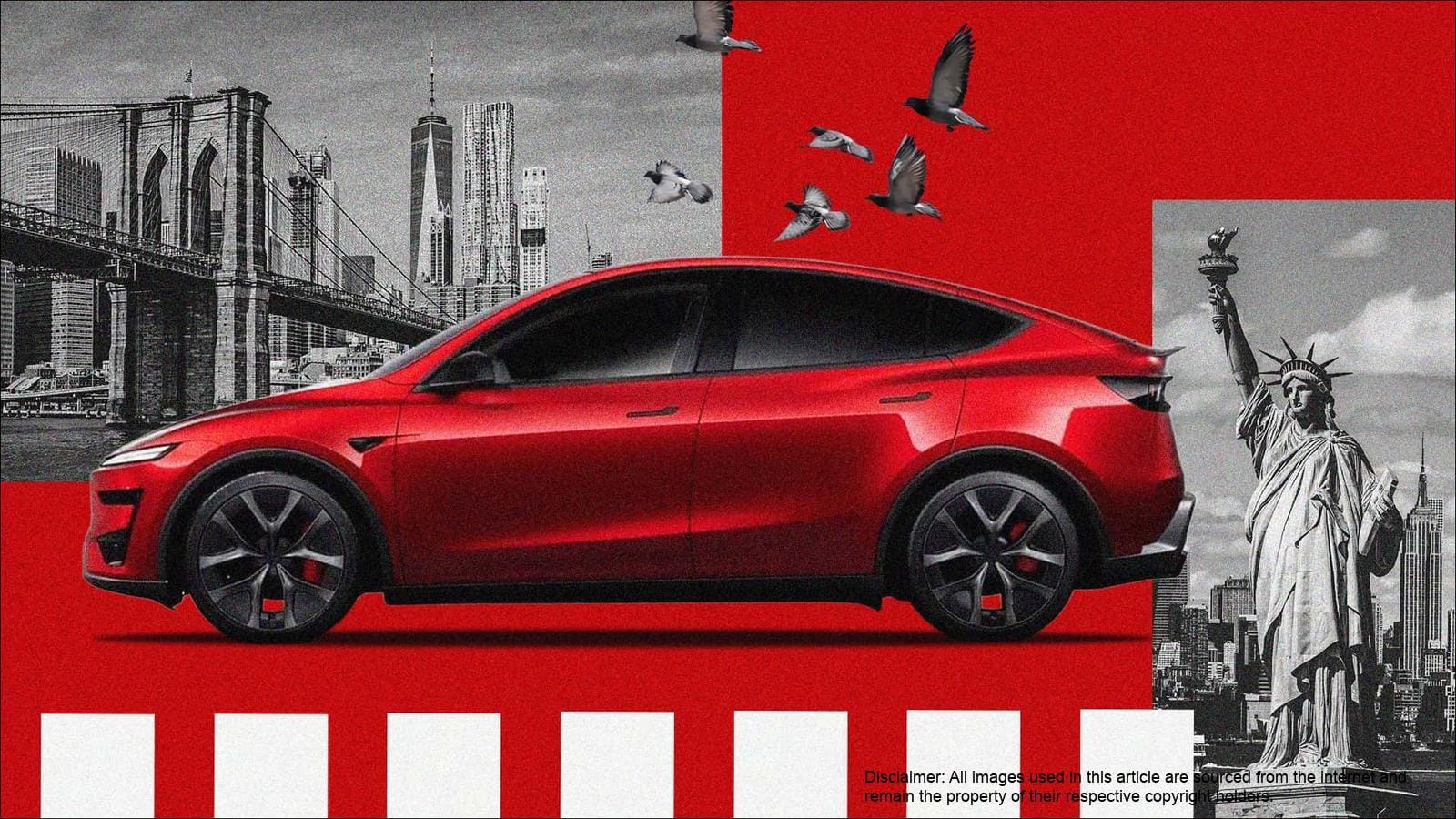

Zeekr’s Bold Move: Integrating Gas Engines into EV Platforms

While the global trend is towards electrification, Chinese automaker Zeekr, a corporate cousin to Polestar and Volvo, is taking a different approach. The company is retooling its EV platform to accommodate gas engines, signaling a potential shift towards hybrids and extended-range EVs (EREVs). Zeekr’s latest flagship “Super Hybrid” crossover, the 9x, exemplifies this strategy.

The Zeekr 9x leverages the state-of-the-art SEA architecture, which has supported over 20 different models in the last five years. The SEA-S architecture, a derivative of the original Sustainable Experience Architecture (SEA), blends the best of BEV and PHEV technologies. One of the key benefits of the 900V SEA-S is its fast-charging capability, allowing the battery to charge from 20% to 80% in just 9 minutes. Additionally, the flagship SUV boasts a long pure electric driving range of 380km (CLTC).

This move by Zeekr is noteworthy, as most manufacturers are focused on electrifying existing gas-oriented platforms. By adding gas engines to its EVs, Zeekr is potentially catering to a broader market and addressing concerns about range anxiety and charging infrastructure availability. The Lynk & Co Z10, another vehicle from the Geely group, will also have a PHEV version, further highlighting this trend.

| Vehicle | Manufacturer | Platform | Type | Notable Feature |

|---|

| Zeekr 9x | Zeekr (Geely) | SEA-S | Super Hybrid Crossover | 900V fast charging, long electric range |

| Lynk & Co Z10 | Lynk & Co (Geely) | N/A | Plug-in Hybrid Sedan | PHEV version available |